Turning payment declines into increased revenues

An AI Driven platform that partners with merchants and payment providers to instantly review and recover failed customer transactions at no risk to the merchant and at no cost to the consumer

Real Time Decisions

Fully Embedded Payment

All Decline Types

Increased Revenues

Better Customer Outcomes

Over $500Bn is lost per year due to declines

Digital commerce drives over $4.5 trillion dollars in sales, but 5-30% of transactions are declined online. Worse, a declined transaction can lead to over 80% of customers leaving the website altogether.

Less than 15% of declines represent actual fraud. The remaining 85% of declines could be successful sales and should be opportunities to retain a lost customer.

Ecommerce

+$500Bn Lost Sales

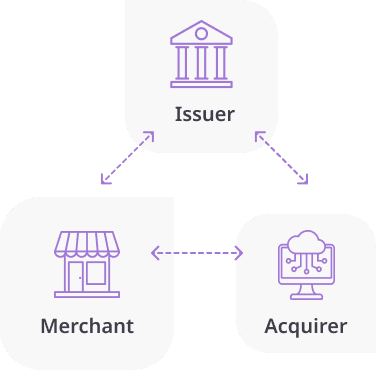

Hundreds of Decline Codes × Merchant Actions × Issuer Actions × Acquirer Actions =

Billions of potential combinations to approve or decline a payment transaction.

Existing solutions are complex and limited in scope

The complexity of rules across merchants, issuers, and processors means there are billions of potential combinations to approve or decline a payment transaction.

Best-in-class merchants use a mix of strategies, including payment orchestration, 3DS, tokenization, and chargeback & fraud detection services to improve their acceptance rate. The gains, however, are limited. With Decline Defense, merchants can maximize the acceptance rate across all payment types.

Decline Defense covers all decline codes

Decline Defense's deep history in machine learning and advanced credit score modeling allows it to incorporate a wider set of information to make effective real-time decisions across all error codes. This includes solving the two biggest decline code reasons: Insufficient Funds and Do Not Honor, often representing approximately 60% of declines.

We are passionate about positive customer outcomes

At Decline Defense we believe that the majority of declines can be cured in a fully embedded, frictionless, and fast customer experience. The customer should get the product they want, paying the way they want, within the credit lines they already have, and at no additional cost to them.